Klima DAO

Introduction

$KLIMA is an algorithmic carbon-backed currency on the Polygon chain aiming to become a liquidity engine for the carbon markets. Klima DAO allows Web3 builders and users to participate in the carbon market through the KLIMA token. KLIMA tokens are fungible, are backed by at least 1 Verified Carbon Unit* in the Klima DAO treasury, and holders of KLIMA will have the ability to vote on Klima DAO policy.

History

A group of anonymous builders launched Klima DAO on 18th October 2021. Klima DAO is a fork of Olympus DAO, and its token $sKLIMA is a rebasing token similar to the mechanism of $sOHM.

IDO and LBP

The Initial Discord Offering (IDO) was announced on Klima DAO's Medium in August 2021.[1] IDO purchases began on Ethereum mainnet August 17th 2021 at 10 Dai / aKLIMA, where users could send 500 or 1,000 Dai to a multi-sig if they were whitelisted. In return, users received an NFT that granted them access to an airdrop of 50 or 100 aKLIMA. aKLIMA is the pre-sale, alpha version that is 1:1 redeemable for KLIMA. The purpose of this IDO NFT sale was to bootstrap funds for the Copper Fair Launch liquidity bootstrapping pool (LBP).

A little over 2 weeks later, Klima announced the LBP details on their Medium.[2] As described on this Medium:

A Balancer Liquidity Bootstrapping Pool is an adjustable balancer smart contract designed to distribute tokens fairly across market participants. LBPs use constant selling pressure and have a limited time duration, during which price continually drops when there is no demand. By using an LBP, Klima DAO can define parameters (such as pool weights and total available supply) and allow the market to converge on a fair price for the token as demand emerges.

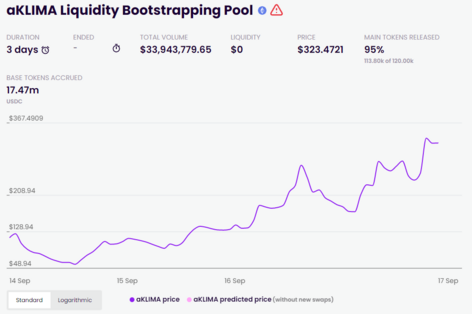

The LBP started on September 14th and ended September 17th. The sale started at approximately $116, reached a bottom of $57.58, and ended at $323.47. 95% of the tokens sold out, and Klima raised 17.47m USDC.[3]

Launch

KLIMA went live on Polygon mainnet October 18th, 2021.[4] The initial launch was delayed by a few hours as someone created a rogue liquidity pair for BCT-KLIMA.[5] Someone acquired BCT ahead of time and made a pool with very low liquidity, and it led to BCT rising in price to $1,600. The team could not set up a second pool for the token on SushiSwap, so they had to sell directly into the low-liquidity pool to lower the price and add enough liquidity to make the pair tradeable.

Mechanism

Bridging Carbon Credits on-chain

Regenerative projects in the real world help remove the greenhouse gases from the atmosphere using reforestation and other regenerative techniques. These projects create an equivalent amount of Carbon credits available on the market through a verification process agreed upon by the voluntary market. These carbon credits are then tradable and are utilized by large companies to offset their carbon footprint by purchasing them off the market. Thus, indirectly funding these projects. However, the current carbon market lacks the liquidity to sustain efficient trading.

Toucan Protocol is a web3 project which provides the infrastructure to bring these off-chain Carbon Credits over to the blockchain. Like we have bridges to send crypto tokens between L1s or L2 blockchains, the Toucan protocol acts as a bridge between the real and blockchain worlds. Users or projects can bridge their Carbon Credits after undergoing the verification and validation process by Verra. Verra ensures valid tokenization and that the real-world carbon credits are retired forever to avoid duplication and malpractices.

Known on-chain tokens for Carbon Credits

BCT: Toucan Base Carbon Tonne

NCT: Nature Carbon Tonne

MCO2: MOSS Carbon Credit Token

Bonding

Klima DAO uses the bonding mechanism from Olympus DAO; that is, they provide $Klima at a discount to anyone who bonds their on-chain carbon credits with their protocol. The users get cheaper $KLIMA, and the protocol grows their treasury of Carbon Credits which is used to back the value of the Klima token.

Intrinsically, the value of 1 $KLIMA token is 1 unit of Carbon Credit, but because there is no cap to how high the price can rise, the value of $KLIMA is up to the market.

Staking

$KLIMA holders can stake their tokens to earn an agreed-upon APY from the DAO voting. The staked KLima token is $sKLIMA, which rebases as per the APY.

Goal

The broader goal of Klima is to become a "Blackhole for Carbon Credits." The DAO's treasury promises to lock in the bonded Carbon, which helps raise the prices of Carbon Credits in the market.

Higher costs to obtain Carbon Credits would subsequently cause companies and organizations to work on reducing their carbon footprint instead of just offsetting them.

Impact

As of 24th, April 2022, 6 months from their launch, Klima DAO has retired 17,254,395 units of Carbon from the market.

Notable Media Mentions

WallStreet Journal: https://www.wsj.com/articles/cryptocurrency-traders-move-into-carbon-markets-11641826402

Nasdaq: https://www.nasdaq.com/articles/crypto-industry-makes-a-moves-into-the-carbon-markets

Australian Financial Review: https://www.afr.com/politics/why-the-price-of-carbon-credits-is-going-to-the-moon-20211101-p594ww

Coin Telegraph: https://cointelegraph.com/news/klima-dao-accumulates-100m-of-carbon-offsets-aims-to-drive-up-price https://cointelegraph.com/news/klimadao-increases-carbon-offset-stash-by-50-in-two-months

Yahoo Finance: https://finance.yahoo.com/news/mobilum-technologies-worlds-first-fiat-123000698.html

Sources

- ↑ https://klimadao.medium.com/what-is-klima-dao-initial-discord-offering-5735c996c2ac

- ↑ https://klimadao.medium.com/klima-dao-fair-launch-pt-2-liquidity-bootstrapping-pool-249ebe507555

- ↑ https://copperlaunch.com/pools/0x6Aa8A7B23F7B3875a966dDCc83D5b675cC9af54B

- ↑ https://klimadao.medium.com/klimadao-launch-reflections-on-our-manifesto-334ae065d80f

- ↑ https://twitter.com/KlimaDAO/status/1450447633009491968/photo/1