PAR

$PAR

PAR is a stablecoin backed by collateral, and can only be minted with governance-approved collaterals. PAR are created when users deposit accepted tokens (such as WETH, WBTC, USDC, etc) as collateral in vaults and in turn receive a loan against that collateral.

Token symbol: PAR

- Token contract (Ethereum): 0x68037790a0229e9ce6eaa8a99ea92964106c4703

- Token contract (Polygon): 0xe2aa7db6da1dae97c5f5c6914d285fbfcc32a128

- Token contract (Fantom): 0x13082681E8CE9bd0aF505912d306403592490Fc7

PAR is non-custodial

There are no counterparties involved in the minting and burning of PAR tokens, as actors in the network transact directly with the PAR smart contracts. Vaults are non-custodial, with each borrower having full control over their collateral and borrowed PAR balances, provided it meets the minimum health factor governed by the protocol as a whole.

How does PAR work?

How are PAR stablecoisn created ?

Users can deposit from a large variety of collateral types (like WBTC) and borrow a safe amount of PAR at low interest. As of May 2022, PAR is over-collateralized by over 6 different tokens on 3 different networks.

What is an over-collateralized stablecoin ?

To retain its value, a stablecoin must have another asset that is put as collateral to back its intrinsic value. That collateral must be redeemable at any time.

PAR has a loan and repayment process utilizing collateralized debt positions (CDPs) via the Mimo Protocol to secure assets as collateral on-chain.

What does this mean for the peg ?

If PAR is trading below 1€, people are incentivized to buy PAR from open markets and pay off loans at a discount. This ensures that PAR won’t be worth substantially less than 1€ at all times.

What is the difference with algorithmic stablecoins ?

Stablecoins are cryptocurrencies that are supposed to be pegged to fiat currencies like the US dollar. In the cases of USD-pegged stablecoins, their prices are supposed to be $1 at all times.

Each stablecoin project differs in ways they maintain the peg. The two biggest ones, tether (USDT) and Circle's usd coin (USDC), are "collateralized” by fiat reserves, meaning they have cash or cash-equivalent assets in their reserves. So each USDT or USDC traded in the crypto market is backed by what’s actually in the possession of the stablecoin issuers.

Over the past year, a new form of stablecoin emerged to increase capital efficiency: algorithmic stablecoins, such as terraUSD (UST), magic internet money (MIM), and neutrino usd (USDN).

Difference

Unlike these projects, the PAR collateral is not the governance token (MIMO), but assets such as WBTC, WETH, USDC, WMATIC, etc. which ensures a better stability than when it is correlated to a governance token with a lower market cap.

Where can I get PAR ?

By Minting

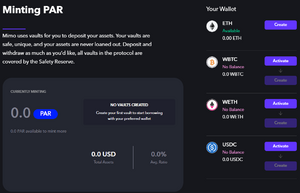

You have the possibility to "mint" PAR against a collateral, for this you will have to create your vault with your corresponding collateral (You have the choice between 6 different collaterals on 3 different chains).

Your vaults are safe, unique, and your assets are never loaned out.

Go to Mimo MINT page and choose to create your vault according to the collateral you have chosen. (At first click on "activate" to approve the creation of your new vault).

Once activate, you can "create" your vault and deposit your collateral and choose how much PAR you want to mint against your collateral.

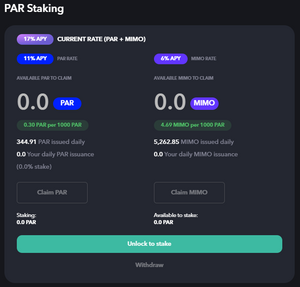

By Staking PAR

By staking PAR, you will be rewarded in MIMO and in PAR.

PAR holder to earn the fees charged by the protocol. By staking $PAR, you will be rewarded in $MIMO and in $PAR (PAR are paid by the Protocol Fees and MIMO from Liquidity Mining).

By Swapping on a DEX

You can get PAR through DEXes or DEX aggregators like Paraswap or 1inch which lets you find the best exchange rate.

By Trading on a CEX

You can also find PAR on centralized exchanges like Bittrex, Liquid, HitBTC or Folgory.

Trade on Folgory - Euro Support, IBAN deposits, debit cards

Trade on Liquid - Euro Support