Harvest Finance

Harvest Finance is a DeFi platform started in August 2020 by an anonymous developer named Bread. Harvest allows any Web3 user to earn yield on their crypto assets via a process called yield farming.

History

Harvest spawned in the middle of ‘DeFi Spring’ in 2020[1] when yield farming was becoming a thing. The platform aggregated yield farming opportunities across DeFi while introducing its own native FARM token.

Harvest’s iconic Chad & Tractor helped the platform stand out from numerous yield aggregators popping out at that time, attracting over $1B in deposits in just weeks after launching.

Today, Harvest is an on-chain organisation maintained by independent users who regularly contribute to and develop the platform.

Farming Strategies

Harvest offers more than 50 yield farming strategies across Ethereum Mainnet, Polygon and Arbitrum. The core principle of Harvest’s strategies is to auto-compound collected fees & rewards.

Socialising network fees that come with auto-compounding attracts farmers of all sizes to come together and use Harvest’s farming strategies instead of doing it solo.

Farming strategies are developed by Harvest’s core contributors and third-party DeFi projects who wish to integrate its solutions for their purposes like liquidity pool bootstrapping.

FARM Vault & Buybacks

Users who deposit FARM tokens into Harvest’s native vault, known as the Profit-Sharing[2] vault, are entitled to performance fees taken from all farming strategies.

Harvest takes a 30% performance fee on Mainnet and 8% on Polygon, and 15% on Arbitrum[3]. The buyback mechanism uses these proceeds to purchase FARM tokens on the open market and distribute them among depositors in the Profit-Sharing vault according to the size of their stake.

Since June 2021, the buyback mechanism points[4] at the FARM pool on Bancor Network. The buyback mechanism applies a constant buying pressure on the FARM token[5].

Governance & Community

Harvest is purely an on-chain organisation with no format entity. Unlike most DeFi protocols, it doesn’t have active on-chain governance proposals about new integrations or collaboration.

Instead, its members believe in an active contribution where decisions are made through regular discussion where anyone has a voice, no matter their FARM holdings.

Only decisions of high significance are put to on-chain[6] voting. These include investments made viaHarvest’s Council of 69[7], changes to protocol fees or pertain to the native FARM token.

FARM Token

FARM token was released on September 1st, 2020, to provide incentives to yield farmers using the Harvest platform. The token was bootstrap launched without any premining, venture capitalist, or investor funds.

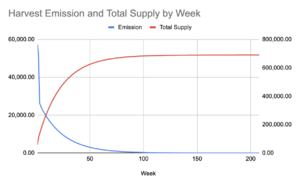

In Week 5, FARM holders voted[8] overwhelmingly to cap the maximum supply to 690,420 tokens by reducing the emissions of tokens by 4.45% every week until week 208 (27 August 2024), which is exactly 4 years from launch. As a result, token emissions are set to follow this curve:

iFARM

The interest-bearing FARM token, iFARM, is a deposit receipt token for FARM that is auto compounding in the Profit Sharing vault. When depositing FARM into the Profit Sharing, iFARM can be obtained by selecting the "Use iFARM" box.

iFARM utilises the same vault architecture as Harvest's other vaults, collecting FARM from users and then depositing it in aggregate into the Profit Sharing. The advantages of iFARM over FARM include:

- Lowers gas costs to deposit FARM into Profit Sharing vault.

- Fungible and transferrable receipt token, iFARM, allows compounding Profit Sharing shares to be transferred between addresses without first unstaking FARM.

- Composability of the iFARM token allows compounding Profit Sharing shares to be utilised in external opportunities, such as providing liquidity for iFARM on Polygon, or minting synthetic stablecoins.

Exploit

In October 2020, Harvest fell victim to a flash-loan attack – a technique that allows a trader to take on massive leverage without any downside. This led to some $24M in stablecoins being siphoned from Harvest’s pools, which accounted for roughly 3% of all deposits on the platform at the time.

Notable Highlights

- FARM is the second asset listed [9]on Coinbase that has fully anonymous founders, right after Bitcoin

- Harvest has made an appearance on Bloomberg[10]

References List

- ↑ https://medium.com/harvest-finance/the-harvest-finance-project-338c3e5806fc

- ↑ https://harvest-finance.gitbook.io/harvest-finance/general-info/what-do-we-do/profit-sharing-pool-ps

- ↑ https://medium.com/harvest-finance/harvest-expands-to-arbitrum-launching-beta-dapp-ft-dolomite-25790d88182c

- ↑ https://medium.com/harvest-finance/harvest-points-its-buyback-mechanism-at-bancor-e71a884df1a1

- ↑ https://twitter.com/Bancor/status/1446418984853819400

- ↑ https://snapshot.org/#/harvestfi.eth/

- ↑ https://harvest-finance.gitbook.io/harvest-finance/general-info/what-do-we-do/420-69-programm

- ↑ https://snapshot.org/#/harvestfi.eth/proposal/QmQvoNCNhz5dARMgR82vFPeHAMPqMahHgsHjPYggFuAkGZ

- ↑ https://blog.coinbase.com/harvest-finance-farm-is-now-available-on-coinbase-d938c7cc773?gi=3f26fed77cc1

- ↑ https://www.bloomberg.com/news/videos/2022-01-19/from-bitcoin-to-defi-in-12-short-years-video