Difference between revisions of "Tokemak"

Justynleung (talk | contribs) (Content regarding overview of tokemak added.) |

m (grammar/added links) |

||

| Line 1: | Line 1: | ||

Tokemak is a layer 2 solution of DEX founded by Carson Cook. The introduction of [https://medium.com/tokemak/introducing-tokemak-the-utility-for-sustainable-liquidity-8b99a4757301 Tokemak] is published on April 29th, 2021. | Tokemak is a layer 2 solution of DEX founded by Carson Cook. The introduction of [https://medium.com/tokemak/introducing-tokemak-the-utility-for-sustainable-liquidity-8b99a4757301 Tokemak] is published on April 29th, 2021. | ||

Tokemak | Tokemak serves as a liquidity router to guide and pair up liquidity. Liquidity providers are protected from impermanent loss and will be rewarded with $TOKE which provides voting power for liquidity directors. | ||

== Overview == | == Overview == | ||

=== Liquidity | === Liquidity Router === | ||

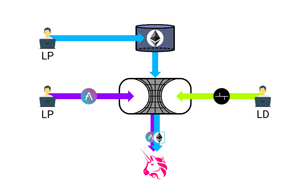

[[File:LDs direct the assets from LPs into Uniswap.png|thumb|300x300px|Tokemak act as liquidity router https://docs.tokemak.xyz/mechanics-and-functionality/general-overview]] | [[File:LDs direct the assets from LPs into Uniswap.png|thumb|300x300px|Tokemak act as liquidity router https://docs.tokemak.xyz/mechanics-and-functionality/general-overview]] | ||

Tokemak | Tokemak pairs up liquidity of different assets from liquidity providers in a token reactor, then the liquidity will be deposited into a DEX like [[Uniswap]]. | ||

=== $TOKE === | === $TOKE === | ||

[[File:TOKEnomics and Emissions.png|thumb|$TOKE tokenomics and emissions https://docs.tokemak.xyz/toke/tokenomics]] | [[File:TOKEnomics and Emissions.png|thumb|$TOKE tokenomics and emissions https://docs.tokemak.xyz/toke/tokenomics]] | ||

Emission and governance token of the protocol. | |||

=== Earning $TOKE === | === Earning $TOKE === | ||

| Line 22: | Line 22: | ||

$TOKE represents the ability to direct any number of tokens in the form of liquidity. Liquidity directors can stake $TOKE and gain proportional amount of voting power. By voting for various token reactors, liquidity directors can earn $TOKE rewards in variable APY. | $TOKE represents the ability to direct any number of tokens in the form of liquidity. Liquidity directors can stake $TOKE and gain proportional amount of voting power. By voting for various token reactors, liquidity directors can earn $TOKE rewards in variable APY. | ||

== | == External links == | ||

Dapp: https://www.tokemak.xyz/ | Dapp: https://www.tokemak.xyz/ | ||

| Line 31: | Line 31: | ||

Discord: https://discord.com/invite/Z5f92tfzh4 | Discord: https://discord.com/invite/Z5f92tfzh4 | ||

== | == References == | ||

# https://docs.tokemak.xyz/ | # https://docs.tokemak.xyz/ | ||

Revision as of 04:30, 24 April 2022

Tokemak is a layer 2 solution of DEX founded by Carson Cook. The introduction of Tokemak is published on April 29th, 2021.

Tokemak serves as a liquidity router to guide and pair up liquidity. Liquidity providers are protected from impermanent loss and will be rewarded with $TOKE which provides voting power for liquidity directors.

Overview

Liquidity Router

Tokemak pairs up liquidity of different assets from liquidity providers in a token reactor, then the liquidity will be deposited into a DEX like Uniswap.

$TOKE

Emission and governance token of the protocol.

Earning $TOKE

- During the pre-liquidity deployment phase (Cycle Zero), early movers can earn the first emission of TOKE tokens by staking in the following pools. ETH, USDC, TOKE, Sushi LP, Uni LP

- Liquidity Providers earn TOKE at a variable APR dependent upon the balance of the Token Reactor. LPs also earn TOKE by depositing assets in the Genesis Pools.

- Liquidity Directors earn TOKE at a variable APR also dependent upon the balance of the Token Reactor.

Tokenized liquidity

$TOKE represents the ability to direct any number of tokens in the form of liquidity. Liquidity directors can stake $TOKE and gain proportional amount of voting power. By voting for various token reactors, liquidity directors can earn $TOKE rewards in variable APY.

External links

Dapp: https://www.tokemak.xyz/

Twitter: https://twitter.com/tokenreactor

Medium: https://medium.com/tokemak

Discord: https://discord.com/invite/Z5f92tfzh4