Trader Joe

Trader Joe is an AMM DEX running on Avalanche that offers swap, stake, farming, lending, borrowing, and leverage options for users. JOE is their native token[1] and can be staked in 3 different options - sJOE, veJOE, rJOE. The protocol is the largest AMM on Avalanche as of writing (April 2022), boasting a TVL (total value locked) of $988.23 million[2]. It was founded in 2021 by 0xMurloc and Cryptofish.[3]

Products

Swap

Token swaps on Trader Joe are a way to trade one token for another via automated liquidity pools.

When you make a token swap on the exchange you will pay a 0.3% trading fee.[4]

- 0.25% - Paid to liquidity pools in the form of a trading fee for liquidity providers.

- 0.05% - Sent to sJOE Staking

Liquidity

Adding liquidity allows the contributor to earn 0.25% swapping fees from the pairs they've provided. Your liquidity can earn rewards such as JOE if they're staked at farms.

When you've provided liquidity, you will receive JLP tokens (Joe Liquidity Provider tokens) as proof of contribution. For example, if a user deposited JOE and AVAX into a pool they would receive JOE-AVAX JLP tokens. These tokens represent a proportional share of the pooled assets.

Trader Joe also allows direct migration of LP positions from Pangolin into Trader Joe.[5]

Yield Farms

The Yield farm is the place to stake JLP (Joe Liquidity Pair tokens) to earn rewards. These farms provide incentives to people providing liquidity and help offset Impermanent Loss risk.

The farm rewards are separated into 3 main types:[6]

- Farmers Market where you earn both JOE + Token X

- noJOE Farm where you only earn Token X

- Farm where you only earn JOE

Banker Joe

Banker Joe is a fork of Compound Protocol[7] and allows users to lend and borrow assets whilst earning JOE rewards. Upon lending an asset, the user is given a receipt in the form of a jToken. It is similar to cTokens on compound where user will obtain said yield upon redeeming for their lended tokens. To borrow assets from Banker Joe, the user has to first deposit collateral due to the permission-less nature of the protocol. The borrowed assets will continue to accrue interest until the borrow balance reaches zero.

By borrowing assets, the user is able to maintain a leveraged position on their portfolio, allowing to capture the maximum upside in an bull market. For example, a user can deposit $10,000 worth of AVAX as collateral and borrow $6,000 worth of USDC.e to build a position of other coins. However, in an extended downtrend, liquidators are able to liquidate the borrowers' collateral in the case the borrowing balance exceeds the borrowing limit and it is imperative that users use Banker Joe with care.

Rocket Joe

Rocket Joe is a protocol-owned-liquidity launch protocol[8] that allows users to join launches of new tokens through depositing rJOE for AVAX allocation and obtaining a JLP of the underlying token + AVAX. The allocation the participant receives is directly proportional to the AVAX contributed. The Rocket Joe launch process is separated into 3 separate phases - Deposit, Withdraw, Launch.

In the Deposit phase, the user is required to deposit their rJOE. To obtain rJOE, the user is required to stake their JOE. The speed at which one accrues rJOE is set as the ‘emission rate * share of pool’. If the user wishes to join a specific launch, the user has to deposit their rJOE into the launch event. Every 100 rJOE translates into 1 AVAX worth of allocation. Upon depositing their rJOE, the rJOE deposited will be burnt. The user can then deposit their AVAX into the launch.

Rocket Joe launches allows for price discovery before launch as participants who deposit their AVAX will define the price in real time. The more AVAX that gets deposited, the higher the issuing token price as more AVAX is paired against the underlying token. The user can withdraw their AVAX in the deposit phase at the cost of their deposited rJOE and a withdrawal fee that varies from 5 - 50%.

In the withdrawal phase, the users are no longer able to deposit anymore AVAX but will be able to withdraw their AVAX. Those who withdraw will lose their deposited rJOE and will pay a similar withdrawal fee in the deposit phase.

In the launch phase, the users will be able to claim their JLP of the launched token + AVAX.

veJOE

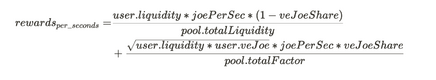

By staking JOE, users will obtain veJOE overtime.[10] veJOE allows the users to enjoy a boosted APR on farms labeled with "Boost APR". The formula is attached at the side. Users can automatically calculate their APR with this website.

veJOE is also used as a governance token to Trader Joe where 1 veJOE counts as 1 vote.

Normally, it will take 365 days for the user to hit the max amount of veJOE they can accrue based on their staked JOE amount. The user is able to 2x their veJOE accrual rate for 15 days by topping up more than 5% of your existing Staked JOE.

Upon unstaking veJOE, users will lose all of their accrued veJOE.

JOE Tokenomics

Staking

The JOE Ecosystem provides users with 'Modular Staking' - 3 ways to stake JOE.

- rJOE: Unlocks the ability to participate in Rocket Joe: Liquidity Launch Platform. Read the Rocket Joe subsection for more information.

- sJOE: Earns Stablecoin rewards by sharing the 0.05% fee generated on the platform

- veJOE: Receives boosted yield to JOE rewards in select Farms + Governance. Read the veJOE subsection for more information.

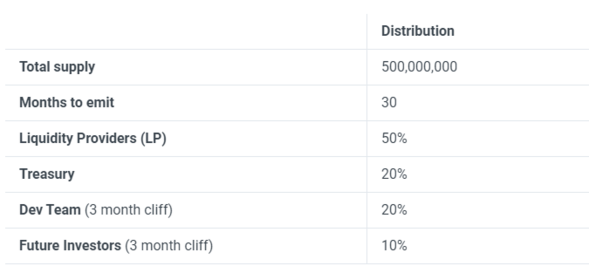

Emissions

There are no pre-sales, private sales or pre-listing allocations of the JOE token.

All tokens are distributed according to emission schedule meaning that the team funds and treasury funds are distributed at same pace as our LP farms.

Trader Joe has an allocation held out for future investors. It means that if Trader Joe were to raise investor funds in the future, these investors would enter after the token launch, and not before.

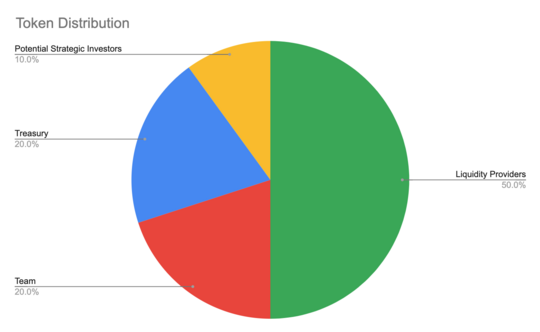

Distribution[11]

All JOE tokens will be emitted according to distribution portion. Team, Treasury and Future Investor funds are emitted at schedule as public distribution to LPs.

Sources

References

- ↑ https://docs.traderjoexyz.com/main/welcome/faq-and-help/general-faq

- ↑ https://defillama.com/protocol/trader-joe

- ↑ https://docs.traderjoexyz.com/main/welcome/about-trader-joe

- ↑ https://docs.traderjoexyz.com/main/trader-joe/exchange

- ↑ https://docs.traderjoexyz.com/main/trader-joe/liquidity-pool-tutorial/migrating-from-pangolin

- ↑ https://docs.traderjoexyz.com/main/trader-joe/yield-farming

- ↑ https://docs.traderjoexyz.com/main/trader-joe/lending

- ↑ https://docs.traderjoexyz.com/main/trader-joe/rocket-joe

- ↑ https://docs.traderjoexyz.com/main/trader-joe/staking/vejoe-staking

- ↑ https://docs.traderjoexyz.com/main/trader-joe/staking/vejoe-staking

- ↑ https://docs.traderjoexyz.com/main/trader-joe/platform/tokenomics#emissions