Difference between revisions of "Yield tokenisation"

(Created page with "alt=Minting Future Yield Token & Principal Token via APWine|thumb|Minting Future Yield Token & Principal Token via APWine Yield tokenisation is a process of deriving yield and principal from an interest-bearing token. For example, Aave’s aDAI is an interest-bearing token that entitles its holder to the underlying deposit and the right to claim the collected yield on it. With yield tokenisation, user...") |

|||

| Line 4: | Line 4: | ||

For example, Aave’s aDAI is an interest-bearing token that entitles its holder to the underlying deposit and the right to claim the collected yield on it. With yield tokenisation, users can separate principal from the rights to the future yield. | For example, Aave’s aDAI is an interest-bearing token that entitles its holder to the underlying deposit and the right to claim the collected yield on it. With yield tokenisation, users can separate principal from the rights to the future yield. | ||

Yield protocols are the new DeFi layer for yield derivatives. They unlock new markets | Yield protocols are the new DeFi layer for yield derivatives. They unlock new markets thanks to two DeFi primitives that represent future yield and principal. | ||

The pillar examples of how this technilogy can be leveraged in DeFi alone are: speculation on the evolution of the yield generated by DeFi assets, hedging from APY volatility and getting future yield in advance. | The pillar examples of how this technilogy can be leveraged in DeFi alone are: speculation on the evolution of the yield generated by DeFi assets, hedging from APY volatility and getting future yield in advance. | ||

Revision as of 11:51, 24 May 2022

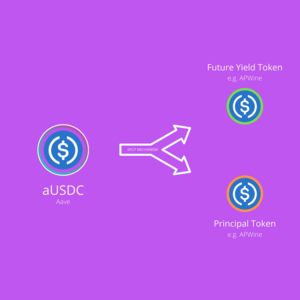

Yield tokenisation is a process of deriving yield and principal from an interest-bearing token.

For example, Aave’s aDAI is an interest-bearing token that entitles its holder to the underlying deposit and the right to claim the collected yield on it. With yield tokenisation, users can separate principal from the rights to the future yield.

Yield protocols are the new DeFi layer for yield derivatives. They unlock new markets thanks to two DeFi primitives that represent future yield and principal.

The pillar examples of how this technilogy can be leveraged in DeFi alone are: speculation on the evolution of the yield generated by DeFi assets, hedging from APY volatility and getting future yield in advance.

History

Yield Tokenisation started with Gaspard Peduzzi launching APWine mid-2020 when yield farming just became a thing. The main problem to solve at the time was ‘how yield farmers can hedge from insane APY volatility?

APWine pioneered yield tokenisation movement with protocols like Element Finance and Pendle Finance following suite mid 2021.

Prime Use Cases

Hedging

Yield tokenisation protocols allow anyone to earn a fixed, rather than variable, yield on your underlying assets such as $DAI or $ETH. This is the prime use case for yield farmers who can lock-in an interest rate for a specific period of time.

Speculation

New primitives representing future yield & principal unlock new markets for traders to speculate on. Similar to speculation on asset’s price as we know it, it is now possible to speculate on the evolution of the yield generated by DeFi protocols as a whole and specific assets.

Upfront Yield

Deriving the right to future yield from an interest-bearing token lets its holder to sell that right in advance on the market. The proceedings can be used to buy other crypto or even cashed out to fiat.