Synthetix

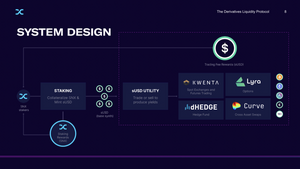

Synthetix is a decentralized synthetic asset issuance protocol built on Ethereum and Optimistic Ethereum (a layer two scaling solution built on Ethereum). These synthetic assets are collateralized by the Synthetix Network Token (SNX) which when locked in the contract enables the issuance of synthetic assets (Synths). This pooled collateral model allows users to perform conversions between Synths directly with the smart contract, avoiding the need for counterparties. This mechanism solves the liquidity and slippage issues experienced by DEX’s. Synthetix currently supports synthetic fiat currencies, cryptocurrencies (long and short) and commodities. SNX holders are incentivized to stake their tokens as they are paid a pro-rata portion of the fees generated through activity on Synthetix from integrators (Kwenta, Lyra, Curve, dHEDGE, and many others). It is the right to participate in the network and capture fees generated from Synth exchanges, from which the value of the SNX token is derived. Trading on the Synthetix infrastructure does not require the trader to hold SNX.

Many protocols have built ontop of the Synthetix infrastructure. These include but are not limited to, Kwenta which offers perpetual futures and spot exchanges, Lyra which offers options trading, Curve which offers cross asset swaps, and dHEDGE which allows traders to pool capital and offer a decentralized hedge fund service.

Why SNX holders stake

Synthetix staking is vastly different from other DeFi protocols; it allows anyone to earn rewards by contributing collateral (SNX) to the Synthetix protocol. Staked SNX enables the many benefits for protocols built on Synthetix, such as deep liquidity, low slippage, and highly competitive fees for traders.

Staked SNX performs several crucial tasks:

- Creates deep liquidity for Synths trading on Synthetix

- Supports various protocols that rely on Synthetix liquidity (Kwenta, Lyra, Curve, dHEDGE, etc.)

- You receive two kinds of rewards for staking SNX: sUSD fees generated from traders (Kwenta Futures, Lyra options, Kwenta Spot, Curve cross-asset swaps, etc) and SNX inflationary rewards.

- Both of these rewards must be manually claimed in the one transaction each fee period (i.e., once a week), or they will be returned to the pool and redistributed to other stakers.

For basic steps on how to stake and for claiming weekly see this guide: https://blog.synthetix.io/basics-of-staking-snx-2022/

Synthetix and Partner Protocols

Why trade synthetic assets?

Synthetic assets provide exposure to an asset without holding the underlying resource. This has a range of advantages, including reducing the friction when switching between different assets, expanding the accessibility of certain assets, and censorship resistance.

**Advantages of Synthetix Infrastructure **

Trading on Synthetix infrastructure provides many advantages over centralized exchanges and order book based DEX’s. The lack of an order book means all trades are executed against the contract, known as P2C (peer-to-contract) trading. Assets are assigned an exchange rate through price feeds supplied by an oracle, and can be converted using the Kwenta.io dApp. This provides infinite liquidity up to the total amount of collateral in the system, zero slippage, and permissionless on-chain trading.

Synthetic futures

Synthetix has recently launched Perpetual Futures Beta. Anyone with access to the internet can leverage Synthetix’s infrastructure to access up to 10x leverage on an evergrowing list of Synthetic assets.

Kwenta, a fully decentralized and composable protocol with an easy-to-use trading UI, is the first partner to integrate Synthetix’s perps. Synthetix perps markets are accessible through a dedicated Kwenta UI.

Synthetix's perpetual futures enable a much expanded and capital-efficient trading experience by allowing both leveraged longs and shorts on a large selection of assets.

For SNX stakers, futures provide an additional revenue stream due to exchange and funding rate fees and reduce the need to hedge the additional debt due to inherent self-hedging and controlled exposure through market size limits.

Another useful property of Synthetix’s perps markets is that support for new assets can be expanded more readily for futures than for spot assets. This is because perpetual markets don’t share some of the limitations and risks of spot synths, allowing for more assets to be safely added. This means that the Synthetix protocol may soon offer a broader range of perpetual futures pairs than many competitors.

History

Synthetix originally launched with an ICO in early 2018 under the name Havven.[1] It was founded by Kain Warwick.[2]