Morpho Labs

Note before reading: in this article, we focus on the fundamentals of the value prop for Morpho, and intentionally leave DeFi protocols incentives through native tokens aside.

Morpho Labs describes itself as:

"A Peer-to-Peer (P2P) layer on top of lending pools like Compound or Aave. Rates are seamlessly improved for both suppliers and borrowers whilst preserving the same liquidity and market risk guarantees."

A bit of history might help here.

Aave started as a peer to peer lending protocol (ETHlend). The idea was to let people enter into a loan agreement for which they would define the main details together.

This was basically a decentralised solution to cut the middleman (aKa: the bank).

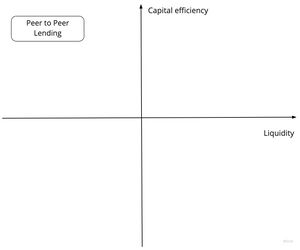

Now let's watch at how ETHlend or peer to peer lending positions along 2 of the main criteria when it comes to money management:

P2P lending is highly capital efficient, because the capital you put at work produces interests for you directly once entered into the loan agreement. However, once you lend it, your capital becomes highly illiquid, as it is in the hands of the borrower.

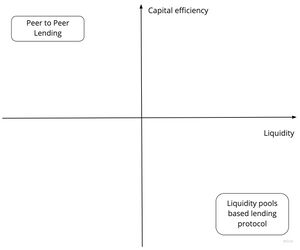

This is one of the main reasons Aave was born, using the concept of Liquidity Pools to allow capital to be liquid (basically to allow lenders to be in or out whenever they want to). Now let's look at the effect of using liquidity pools for decentralised lending/borrowing:

Now we see that liquidity pools have actually moved the needle concerning the pain point they were aiming to tackle. They've had an interesting side effect, due to a strong imbalance between offer and demand. Long story short, there is a lot more lenders than borrowers, which creates a discrepancy in terms of borrowing rates vs lending rates.

Since LPs are mutualised funds, the performance for the lenders is by design inferior to what peer 2 peer lending could offer, and when the imbalance between offer and demand increases, the performance discrepancy increases. It is also important to note that it's conceptually impossible to match lenders and borrowers rates while directly using LPs since it would mean the assets are not liquid anymore.

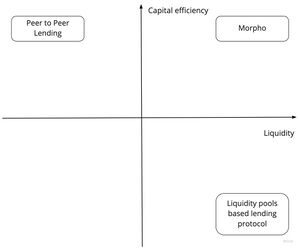

Morpho's angle to optimize this:

Morpho plugs itself on peer to pool (Compound, Aave, etc) DeFi providers as a peer to peer lending/borrowing service.

Their value prop is that if Jack borrows through Morpho instead of Aave he will take advantage of lower rates, and if Megan provides funds through Morpho instead of Aave, she will get much higher rates than if she does so through Aave.

On top of that, Morpho guarantees liquidity by being plugged on Aave, so in case Mega wants out of the position, Morpho will gave her her funds back by borrowing it on Aave, then adjusting the rates accordingly.

It is literally peer to peer lending built on top of existing liquidity based protocols, aiming to:

The way they do it is obviously a bit more complicated than that, and technically more advanced, but this is a fair way to describe their value prop.

Some ressources