Liquity

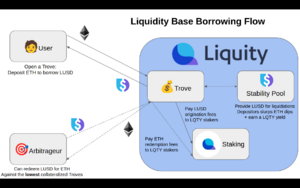

Liquity is a smart contract lending service enabling users to take out over-collateralized loans by locking ETH as collateral to borrow LUSD, a stablecoin pegged to the U.S. dollar. Once generated, LUSD can serve diverse usage: a hedge against volatility, a tool to get leverage on ETH, or even access yields through DeFi applications.

Launched in April 2021, the platform grew to a total value locked of $1.15 billion as of April 2022.[1]

The service provided by Liquity is similar to MakerDAO, but the protocol has several specificities, the main one being that Liquity and LUSD are fully unstoppable: the services are enabled thanks to smart contracts that have no administrative functions. It means that just like Uniswap, the Liquity protocol cannot be modified in any way and will operate as long as the Ethereum network synchronizes.

The LUSD Stablecoin

The LUSD stablecoin is a decentralized, unstoppable, and collateral-backed cryptocurrency soft-pegged to the US Dollar. LUSD is created when users borrow against locked collateral. LUSD tokens are destroyed upon repayment, freeing a corresponding amount of the underlying collateral.

Collateral

Liquity is only a borrowing service: there are no lenders. Instead, the protocol itself acts as the counter party of the borrow, just like with MakerDAO.

The only token accepted as collateral on Liquity is Ether (ETH). While it is restricting, it also allows the protocol to avoid frequent trustlessness pitfalls observed in other decentralized stablecoins, such as DAI or FRAX, whose majority of the collateral backing them are centralized and censurable stablecoins such as USDC.

Service Fees

The fee structure on Liquity differs from the usual interest rate charged to borrowers on Maker or Aave. Instead, Liquity provides interest-free borrowing: a unique one-time borrowing fee is paid while minting LUSD.

The base fee is 0.50% of the borrowed amount. However, this figure can dynamically increase to preserve the protocol's equilibrium during periods with large demands for LUSD minting or redemptions.[2]

Usecases

Since Liquity provides interest-free borrowing, it is particularly cost-effective for long-term positions. Borrowing on Liquity can serve various use-cases, including:

- To earn income on ETH, users can mint LUSD to deposit them in the Stability Pool or other DeFi services in order to earn yields.

- Borrowing against collateral instead of selling it can have benefits when it comes to tax.

- Recursive borrowing to achieve leverage on an ETH position (Deposit ETH > Borrow LUSD > Swap to ETH > Loop)

LUSD in DeFi

The primary source of liquidity for LUSD is the LUSD/3pool on Curve.[3] It has a corresponding Yearn Vault, and it's also available through Convex.

LUSD is also available in the Saddle D4 pool, along with alUSD, FEI and FRAX.[4]

Finally, DAOs such as the OlympusDAO also took interest in LUSD: its desirable resiliency draw the DAO to accumulate it as an alternative reserve asset. Thanks to bonds, about 12 millions LUSD are part of the OHM/LUSD SushiSwap pool (Olympus protocol owned liquidity). OlympusDAO also owns about 23 millions LUSD staked in the Stability Pool.[5]

Holders of LUSD can also earn LQTY yields by depositing in the Stability Pool detailed in the next section.

Liquity Protocol

Troves

The troves are the equivalent of MakerDAO's vaults. It's the contract enabling the user to lock its ETH in order to borrow LUSD. While the protocol is operating normally, a minimal collateralization ratio of 110% is required, meaning users can borrow at max about 90% of the value of their ETH in LUSD. When a given troves goes below a collateralization ratio of 110% (or 150% in Recovery Mode), it can be liquidated.

Troves can be managed by end-user directly through one of the several Liquity front-ends. However, Liquity is also supported by service providers such as DeFiSaver[6] or InstaDapp[7], enabling users to conveniently manage their troves and set up automated strategies to avoid liquidations.

Liquidations

Liquidations are a control mechanism triggered when needed to ensure the entire LUSD stablecoin supply remains fully backed by sufficient collateral.

Troves that fall under a minimal collateralization ratio of 110% (or 150% in recovery mode) can be liquidated. The funds of the Stability Pool (>300M LUSD as of April 2022) are critical in this operation. Here is a rough outline of the procedure

- A given trove enter the liquidation zone (<110% collateralization ratio)

- Once the liquidation is triggered, the debt of the Trove is canceled and absorbed by the Stability Pool.

- The corresponding collateral is distributed to the suppliers of the Stability Pool.

- The owner of the Trove still keeps the full amount of LUSD borrowed but loses ~10% value overall.

- Anyone can trigger liquidations, and it can even be lucrative. The initiator receives a gas compensation (200 LUSD + 0.5% of the Trove's collateral) as a reward for this service.

Stability Pool

The Stability Pool serves as a liquidity backstop for the protocol. It's a pool made of LUSD deposited by users and used to ensure liquidations can happen when needed.

Users staking LUSD in the Stability Pool earn a yield in LQTY, Liquity's native token. During a liquidation, the debt of the Trove is canceled and absorbed by the Stability Pool, and its collateral is distributed among its suppliers.

Therefore, over time Stability Pool depositors lose a pro-rata share of their LUSD deposits, while gaining a pro-rata share of the liquidated collateral (ETH).

Recovery Mode

The Recovery Mode is an extreme measure and a deterrent to ensure borrowers behave responsibly. It is triggered when the Total Collateral Ratio (of the whole platform = all troves) goes below 150%.

Once the Recovery Mode is triggered, any safe below a collateralization ratio of 150% can be liquidated. During recovery mode, user actions are restricted: any trove-related action that lowers the collateralization ratio below 150% is blocked. New troves can only be opened if they have a ratio >150% and 0% borrowing fees.[8]

The Recovery Mode is an emergency mechanism and not a desirable state for the system. Its purpose is to restore the collateralization level of the whole platform to a sustainable range. The Recovery Mode also acts self-negating deterrent: the possibility of it occurring actually guides the system away from ever reaching it.

So far, the Recovery Mode was triggered only once during the ETH flash crash that occurred May 19th 2021. 189 Troves were liquidated during the triggering of the Recovery Mode for a total of 93.5M of LUSD debt offset and 48 668 ETH earned by Stability Pool depositors. A detailed post-mortem of the event is available on the Liquity's blog.[9]

Redemption

Redemption is an arbitrage mechanism helping to maintain the soft peg of LUSD when it's below $1. It enables users to exchange LUSD for ETH at face value, as if 1 LUSD is exactly worth $1. A minimum fee of 0.5% is charged on redemptions and it can increase when there is a lot of demand for either redemption or borrowing, as the "baseRate" raises up. The redemption fee is paid to LQTY stakers.

Redemptions are a system-wide mechanism. When a user redeems, the ETH is taken from the lowest collateralized troves on Liquity. The corresponding amount of LUSD debt for the affected troves is burned. To avoid being redeemed against, a Trove user should make sure to keep a collateralization ratio superior to his peers.

Dual Oracles + Fallback system

The oracle (price feed) is the source of truth used by lending services to determine whether or not a position is sufficiently collateralized. Since the system makes decisions based on this information, it is critical. With Liquity the base situation is even harsher because the code is immutable, meaning that the oracle too cannot be changed.

To address this while maximizing the resiliency of the protocol, Liquity implements a dual oracle mechanism with a fallback logic.

The base oracle is the Chainlink ETH/USD price feed[10]. However, there is a fallback to the Tellor ETH/USD price feed[11] if the following three (extreme) conditions are met:

- Chainlink price has not been updated for more than 4 hours

- Chainlink response call reverts, returns an invalid price or an invalid timestamp

- The price change between two consecutive Chainlink price updates is >50%.

Front-end decentralization

To maximize the decentralization and resilience of the protocol, the Liquity team does not operate the front-end of the application itself. Instead, the team provided a front-end launch kit and a front-end SDK enabling third parties to host and run front-ends for the Liquity protocol. To incentivize the endeavor, front-end operators can set up a kickback rate which capture a share of the LQTY earned by their users depositing into the Stability Pool.

Most front-end operators set up the kickback rate to 90% at least, and often to 99%, meaning the capture only 1 to 10% of the LQTY earned by their users. A list of the front-end and their kickback rates is available on the Liquity website.

The LQTY Token

The LQTY token is not a governance token: since Liquity's contract are immutable there is no need for governance. It captures the fee revenue that is generated by the system and incentivizes early adopters and frontend operators.

The total supply of LQTY is 100 000 000. Additional details about the token allocation can be found in Liquity's introduction post.

LQTY is earned by supplying LUSD to the Stability Pool or by front-end operators facilitating this operation. During the first 6 weeks of the service, LP of the Uniswap LUSD/ETH also earned LQTY.

LQTY DeFi Integrations

- ↑ https://defillama.com/protocol/liquity

- ↑ https://docs.liquity.org/faq/lusd-redemptions#how-is-the-baserate-calculated

- ↑ https://curve.fi/lusd

- ↑ https://saddle.exchange/#/pools/d4/deposit

- ↑ https://app.olympusdao.finance/#/dashboard/treasury

- ↑ https://app.defisaver.com/liquity/manage

- ↑ https://defi.instadapp.io/liquity

- ↑ https://docs.liquity.org/faq/recovery-mode#what-is-recovery-mode

- ↑ https://medium.com/liquity/how-liquity-handled-its-first-big-stress-test-160f20d5b18f

- ↑ https://data.chain.link/ethereum/mainnet/crypto-usd/eth-usd

- ↑ https://tellor.io/