LUNA Collapse in May 2022

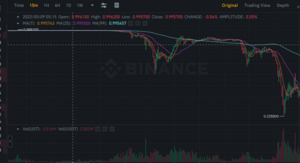

In May 2022, bearish crypto conditions resulted in the depeg of subsequent collapse of LUNA which crashed from over $80 to $0.69 in the space of five days. UST is the stablecoin which can be minted with LUNA as part of the Terra ecosystem which is ran by Do Kwon.

The collapse wiped over $40b in value in the Terra ecosystem and caused most cryptocurrencies to decline by over 20%.

Background

UST is a stable coin which can be minted by burning LUNA. Its redemption mechanism lets a user mint LUNA by burning UST which put further sell pressure on the stablecoin peg. In case of a depeg event, this mechanism adds severe sell pressure on LUNA as more people burn UST to then sell LUNA.

To alleviate concers about a death spiral, the Terra foundation purchased several billions of Bitcoin that could be used to help stabilize the peg in case of pressure on UST and LUNA.[1]

Initial depeg

Over the 7th of May, 9 figures of liquidity was removed from the Curve Finance pool resulting in widespread panic and a depeg of around 2% which was quickly brought under control. DoKwon implied on Twitter[2] there had been a coordinated attack to create panic and destabilize the peg by simulatenously removing funds from Anchor and Curve Finance. The Luna Guard Foundation also announced it had loaned $1.5b as a further effort to protect UST[3].

Rescue efforts and second depeg

As concern for a death spiral kept mounting, The Block reported that the Luna Foundation Guard was raising over $1b to prevent any further damages[4]. The deal would allow several large investment firms to purchase discounted and locked LUNA tokens.

When the price of LUNA kept declining, rumours spread that the deal had fallen apart and that the bailout would not be coming after all and UST further declined to a low of $0.22. LUNA also fell by over 90% to a low of $0.69.

Citadel and BlackRock denied involvement in the attack against Luna after rumours surfaced on Twitter that the two firms were involved in the attack..[5]

Do Kwon tweeted that Terra would increase the redemption capacity of UST to allow the peg to stabilize quicker.[6]

Aftermath

Crypto fund Arca whose main holding was UST incurred significant losses and emailed investors to let them know they believed UST would regain its peg.[7]

US Treasury Secretary Janet Yellen mentioned the depeg event to suggest the need for further regulation of stablecoins.[8]

Terra TVL went from $35b to less than $3b in five days[9].

TVL for the entire DeFi industry declined by over 50%.

As wider concerns for the health of stablecoins spread in the markets, Curve Finance saw a lot of traders swapping away from Tether's USDT. Another algorithmic stablecoin called USDN also fell to as low as $0.78.[10]

Crypto markets also declined by over 20% with some currencies tied to the Terra ecosystem falling by over 60% in two days.[11]

Sources

- ↑ https://dashboard.lfg.org/

- ↑ https://twitter.com/CaetanoManfrini/status/1523145923571814400

- ↑ https://twitter.com/LFG_org/status/1523512201088143360

- ↑ https://www.theblockcrypto.com/post/145978/luna-foundation-guard-seeks-more-than-1-billion-to-shore-up-ust-stablecoin-sources

- ↑ https://www.bloomberg.com/news/articles/2022-05-11/citadel-securities-says-not-involved-in-terra-stablecoin-crash

- ↑ https://twitter.com/stablekwon/status/1524331171189956609

- ↑ https://www.coindesk.com/business/2022/05/11/crypto-fund-arca-doubled-down-on-ust-amid-stablecoins-collapse/

- ↑ https://www.coindesk.com/policy/2022/05/11/ust-meltdown-hasnt-spurred-us-financial-stability-council-meeting-sources/

- ↑ https://defillama.com/chain/Terra

- ↑ https://blockworks.co/how-will-ust-crash-impact-other-stablecoins/

- ↑ https://decrypt.co/100102/not-just-terra-apecoin-avalanche-solana-shiba-inu-all-down-at-least-20-in-crypto-crash