Difference between revisions of "LUNA Collapse in May 2022"

(→Rescue efforts and second depeg: more updates w/ terra ecosystem plan from Do Kwon) |

0xBigDaddy (talk | contribs) |

||

| Line 28: | Line 28: | ||

* All Luna besides the third tranche should be staked at the network genesis state. | * All Luna besides the third tranche should be staked at the network genesis state. | ||

* The network should incentivize its security with a reasonable inflation rate, say 7%, as fees will no longer be enough to pay for security without the swap fees. | * The network should incentivize its security with a reasonable inflation rate, say 7%, as fees will no longer be enough to pay for security without the swap fees. | ||

</blockquote>The efforts are ongoing. | </blockquote>On May 14th, LUNA rebounded over 1,500% from lows and overtook UST market cap for the first time since the beginning of the depegging event. | ||

The efforts are ongoing. | |||

== Chainlink Oracle failure == | == Chainlink Oracle failure == | ||

Revision as of 10:09, 14 May 2022

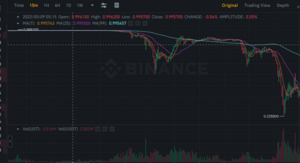

In May 2022, bearish crypto conditions resulted in the depeg and subsequent collapse of LUNA and UST which crashed from over $80 to $0.69 in the space of five days. UST is the stablecoin which can be minted with LUNA as part of the Terra ecosystem which is ran by Do Kwon.

The collapse wiped over $40b in value from the Terra ecosystem and the wider cryptocurrency market subsequently declined by over 20%.

Background

UST is an algorithmic stablecoin which can be minted by burning LUNA. The redemption mechanism lets a user mint LUNA by burning UST which put further sell pressure on the stablecoin peg. In case of a depeg event, this mechanism adds severe sell pressure on LUNA as more people burn UST to then sell LUNA.

To alleviate concerns about a death spiral, the Terra foundation purchased several billion dollars of Bitcoin that could be used to help stabilize the peg in case of pressure on UST and LUNA.[1]

Initial depeg

Over the 7th of May, 9 figures of liquidity was removed from the Curve Finance pool resulting in widespread panic and a depeg of around 2% which was quickly brought under control. Do Kwon implied on Twitter[2] there had been a coordinated attack to create panic and destabilize the peg by simultaneously removing funds from Anchor and Curve Finance. The Luna Guard Foundation also announced it had loaned $1.5b as an additional effort to protect UST.[3]

Rescue efforts and second depeg

As concern for a death spiral kept mounting, The Block reported that the Luna Foundation Guard was raising over $1b to prevent any further damages.[4] The deal would allow several large investment firms to purchase discounted and locked LUNA tokens.

When the price of LUNA kept declining, rumors spread that the deal had fallen apart and that the bailout would not be coming after all and UST further declined to a low of $0.22. LUNA also fell by over 90% to a low of $0.69.

Citadel and BlackRock denied involvement in the attack against Luna after rumors surfaced on Twitter that the two firms were involved in the attack.[5]

Do Kwon tweeted that Terra would increase the redemption capacity of UST to allow the peg to stabilize quicker.[6] This would result in more LUNA being in circulation, with some crypto twitter users estimating a 6x increase in circulating supply.[7] From May 11th to 12th, it has resulted in LUNA’s supply increasing from 1.5 billion tokens to 110 billion tokens so far, and is expected to continue to rise.[8] On May 12th, LUNA hit a low of $0.00079.

On May 13th, Do Kwon released a Terra Ecosystem Revival Plan on the Terra forum.[9] If approved, this proposal would reset the network ownership to 1B tokens and have a new distribution plan:

Validators should reset the network ownership to 1B tokens, distributed among:

- 400M (40%) to Luna holders before the depegging event (last $1 tick before the depeg on Binance should be reasonable), bLuna, LunaX and Luna held in contracts should also be recipients, minus the Terraform Labs account at terra1dp0taj85ruc299rkdvzp4z5pfg6z6swaed74e6. The new chain should be community owned. Preserving decent ownership of the network in its strongest believers and builders is important.

- 400M (40%) to UST holders pro-rata at the time of the new network upgrade. UST holders need to be made whole as much as possible

- 100M (10%) to Luna holders at the final moment of the chain halt – last minute marginal luna buyers should be compensated for their role in attempting to provide stability for the network

- 100M (10%) to the Community Pool to fund future development.

- All Luna besides the third tranche should be staked at the network genesis state.

- The network should incentivize its security with a reasonable inflation rate, say 7%, as fees will no longer be enough to pay for security without the swap fees.

On May 14th, LUNA rebounded over 1,500% from lows and overtook UST market cap for the first time since the beginning of the depegging event.

The efforts are ongoing.

Chainlink Oracle failure

On the 12th of May 2022, Venus on BSC and Blizz Finance on Avalanche were exploited for $13M and $6M respectively. It was revealed the LUNA oracle had a lower limit of $0.10. When the price of LUNA crashed to $0.00005, attackers were able to provide collateral and borrow a lot more than it was worth.

Aftermath

Crypto fund Arca whose main holding was UST incurred significant losses and emailed investors to let them know they believed UST would regain its peg.[10]

US Treasury Secretary Janet Yellen mentioned the depeg event to suggest the need for further regulation of stablecoins.[11]

Terra TVL went from $35b to less than $3b in five days.[12]

TVL for the entire DeFi industry declined by over 50%. From May 7th to May 11th, Anchor’s UST deposits depleted from $17b to $2.6b.[13]

As wider concerns for the health of stablecoins spread in the markets, Curve Finance saw a lot of traders swapping away from Tether's USDT. Another algorithmic stablecoin called USDN also fell to as low as $0.78.[14]

Crypto markets also declined by over 20% with some currencies tied to the Terra ecosystem falling by over 60% in two days.[15]

It was revealed that Do Kwon was the founder of a previous failed stablecoin, Basis Cash.[16]

From May 9th to the 12th, LUNA supply has increased 35,000% as that is part of the mechanism to restore peg to UST.[8]

Terra validators have decided to halt the Terra chain to prevent governance attacks following severe $LUNA inflation and a significantly reduced cost of attack. Terra blockchain was officially halted at a block height of 7603700[17]

After patching the code and disabling validators, Terra blockchain resumed block production.[18]

Investors and Promotors

Several promotors and venture capital funds suffered large losses. The exact amounts are difficult to verify, since people are unwilling to say that

- Arca - Published investor letter in May 2022, describing the de-peg as a buying opportunity[19]

- Delphi Digital - Rumors of $500m loss[20]

- Arrington Capital - $100m UST yield fund[21]

- Galaxy Digital - $300m loss (no mention of cause)[22]

- 3 Arrow Capital - promoted and invested in LUNA. The CIO's Twitter posts implies that they lost money[23]

Sources

- ↑ https://dashboard.lfg.org/

- ↑ https://twitter.com/CaetanoManfrini/status/1523145923571814400

- ↑ https://twitter.com/LFG_org/status/1523512201088143360

- ↑ https://www.theblockcrypto.com/post/145978/luna-foundation-guard-seeks-more-than-1-billion-to-shore-up-ust-stablecoin-sources

- ↑ https://www.bloomberg.com/news/articles/2022-05-11/citadel-securities-says-not-involved-in-terra-stablecoin-crash

- ↑ https://twitter.com/stablekwon/status/1524331171189956609

- ↑ https://twitter.com/pythianism/status/1524432742892507136

- ↑ 8.0 8.1 https://terrasco.pe/mainnet/luna/supply

- ↑ https://agora.terra.money/t/terra-ecosystem-revival-plan/8701

- ↑ https://www.coindesk.com/business/2022/05/11/crypto-fund-arca-doubled-down-on-ust-amid-stablecoins-collapse/

- ↑ https://www.coindesk.com/policy/2022/05/11/ust-meltdown-hasnt-spurred-us-financial-stability-council-meeting-sources/

- ↑ https://defillama.com/chain/Terra

- ↑ https://defillama.com/protocol/anchor#

- ↑ https://blockworks.co/how-will-ust-crash-impact-other-stablecoins/

- ↑ https://decrypt.co/100102/not-just-terra-apecoin-avalanche-solana-shiba-inu-all-down-at-least-20-in-crypto-crash

- ↑ https://www.coindesk.com/tech/2022/05/11/usts-do-kwon-was-behind-earlier-failed-stablecoin-ex-terra-colleagues-say/

- ↑ https://twitter.com/terra_money/status/1524785058296778752

- ↑ https://twitter.com/terra_money/status/1524812171179327488

- ↑ https://www.coindesk.com/business/2022/05/11/crypto-fund-arca-doubled-down-on-ust-amid-stablecoins-collapse/

- ↑ https://members.delphidigital.io/reports/mapping-the-moon-an-overview-of-terras-ecosystem/

- ↑ https://twitter.com/CoinDesk/status/1524506527368888320

- ↑ https://www.coindesk.com/business/2022/05/13/galaxy-digital-sees-quarter-to-date-loss-of-300m/

- ↑ https://twitter.com/zhusu/status/1525045033216397312