Difference between revisions of "APY.Finance"

Jump to navigation

Jump to search

m |

(add category + token distribution) |

||

| Line 6: | Line 6: | ||

* Over 99% gas savings on rebalance fees compared to independent manual yield farming. | * Over 99% gas savings on rebalance fees compared to independent manual yield farming. | ||

* Over 80% gas savings on deposit and withdrawal fees compared to other yield farming aggregators.<ref>https://docs.apy.finance/whitepaper/litepaper</ref> | * Over 80% gas savings on deposit and withdrawal fees compared to other yield farming aggregators.<ref>https://docs.apy.finance/whitepaper/litepaper</ref> | ||

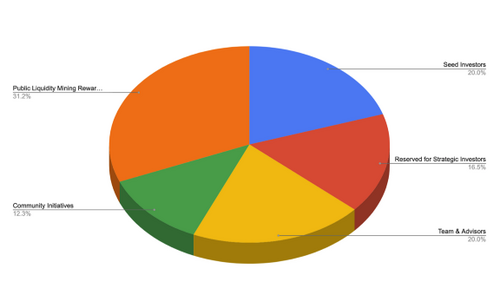

=== APY Token Distribution === | |||

[[File:Token Allocation apy.png|center|thumb|500x500px|Token Allocation apy]] | |||

== References == | == References == | ||

<references /> | <references /> | ||

[[Category:Protocols]] | [[Category:Protocols]] | ||

[[Category:Yield]] | |||

Latest revision as of 12:09, 18 July 2022

The APY.Finance platform is a yield farming robo-advisor that runs a portfolio of yield farming strategies from a single pool of liquidity. Key features of APY.Finance include:

- Capture growth across the DeFi industry with a single deposit.

- Diversified portfolio of yield farming strategies to reduce smart contract risk and yield volatility.

- Automatic portfolio rebalancing to optimize risk-adjusted yield.

- Over 99% gas savings on rebalance fees compared to independent manual yield farming.

- Over 80% gas savings on deposit and withdrawal fees compared to other yield farming aggregators.[1]